NEW YORKERS SUPPORT TAXING THE ULTRA RICH

AN OVERWHELMING MAJORITY OF NEW YORKERS FAVOR LEGISLATION TO ADDRESS THE BUDGET SHORTFALL BY RAISING TAXES ON INCOMES OVER $1,000,000.

Support crosses party lines and is found in all parts of the state:

Democrats

Republicans

Independents

NYC Voters

Suburban Voters

Upstate Voters

RAISING TAXES ON THE ULTRA-WEALTHY IS ACCEPTABLE, BUT NOT CUTTING SERVICES

Voters express clear priorities for addressing the state’s expected budget shortfall: raise taxes on those with high incomes instead of cutting essential services.

Raise taxes on incomes greater than $5 million

Raise taxes on incomes greater than $1 million

Raise taxes on incomes greater than $500,000

Reduce funding for roads, bridges, transportation

Reduce unemployment benefits

Reduce funding for K-12 public schools

Reduce healthcare funding for low-income families and seniors

Reduce funding for services for elderly/disabled

THE MYTH OF MOVING MILLIONAIRES

-

83% more millionaires since the NYS millionaires tax

-

10% more millionaires in the first year after it was imposed

-

30% more millionaires in two years after 2003 NYC tax on wealthy

-

Comptroller report found millionaires “least likely to move” after NYC tax increase

-

Repeated academic studies show working and middle-class people far more likely to move than the super-rich

If you tax the rich, they won't leave: US data contradicts millionaires' threats

Voters reject the claim needed tax measures should not be enacted because it may cause high-income people to leave New York State.

70% agree

In this crisis, we need shared sacrifice, which includes asking the wealthiest to pay slightly higher taxes so services aren't slashed.

30% believe

Many wealthy New Yorkers will just move to other states to avoid new taxes, and businesses will be less likely to come here.

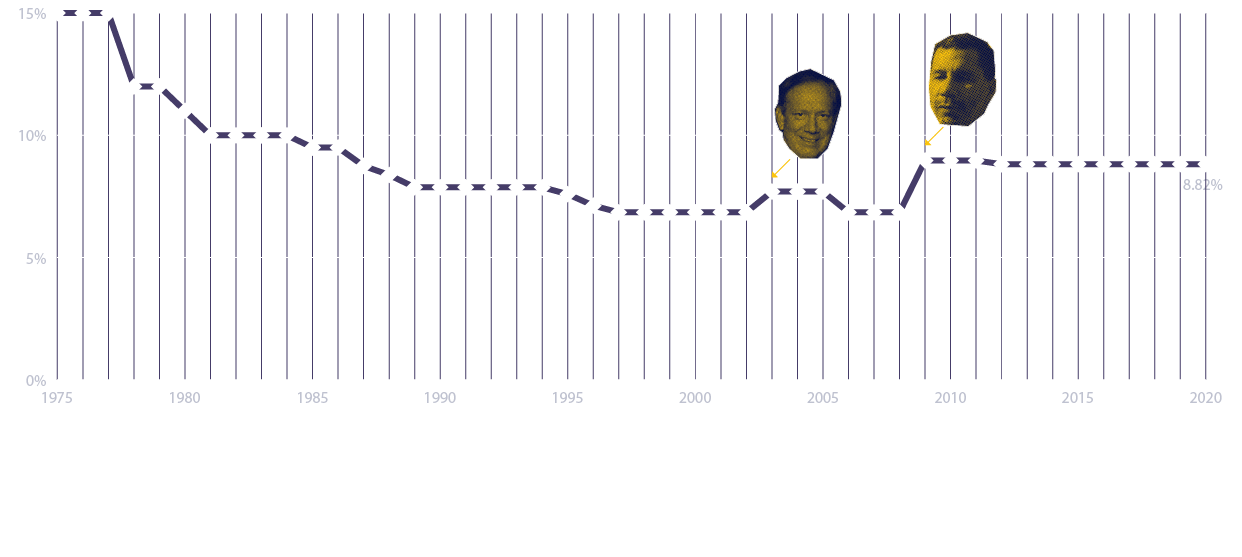

INCOME TAX RATES WOULD STILL BE LESS THAN CALIFORNIA & NEW JERSEY & LOWER THAN NEW YORK IN 1975

TOP NEW YORK STATE TAX RATE, 1975-2020

SHARED SACRIFICE IS NORMAL IN A TIME OF CRISIS

FDR and Herbert Lehman raised taxes on the wealthy by 2% during the Great Depression.

Nelson Rockefeller raised taxes on the wealthy by 3% during the “Eisenhower Recession” of 1958-59, and by 4.9% during the recession of 1961.

Legislative leaders raised taxes on the wealthy by 1.1% in 2003 during the post-9/11 recession over George Pataki’s vetoes.

David Paterson raised taxes on the wealthy by 1.1% after the financial collapse in 2009 with the first Millionaires Tax.